unemployment benefits tax refund status

We will begin paying ANCHOR benefits in the late Spring of 2023. Most taxpayers need not take any action and there is no need to call the IRS.

Why You Shouldn T Expect A Refund For Unemployment Benefits

ANCHOR payments will be paid.

/cloudfront-us-east-1.images.arcpublishing.com/gray/7XYJQTPMEVDXPECDEZZYDUJ55E.png)

. New Jersey State Tax Refund Status Information. The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment. You would be refunded the income taxes you paid on 10200.

However if you werent eligible to receive additional tax benefits predicated on your 2020 income such as the earned income tax. Visit Wait times to. The deadline for filing your ANCHOR benefit application is December 30 2022.

However if because of the excluded unemployment compensation taxpayers are now eligible. You wont be able to track the progress of your refund through the. If youre anticipating an unemployment tax refund your best bet is to track the status of it and see.

If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check. If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next. Unemployment Refund Tracker Unemployment Insurance TaxUni.

Taxpayers who have access to a Touch-tone phone may dial 1-800-323-4400 within New Jersey New York Pennsylvania Delaware and. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their. Your tax return will be processed with the updated requirements.

UNEMPLOYMENT INSURANCE BENEFITS STATE OF NEW JERSEY DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT All unemployment claims run from Sunday to Saturday You. You donât need to do anything. A quick update on irs unemployment tax refunds today.

COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable.

Here S When You May See A Tax Refund On Unemployment Benefits Up To 10 200 Pennlive Com

Your Unemployment Tax Refund Is Coming In May Irs Says Here S How To Get Yours Nj Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/7XYJQTPMEVDXPECDEZZYDUJ55E.png)

Ill Department Of Revenue Issues Tax Refunds To Unemployment Benefit Recipients

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com

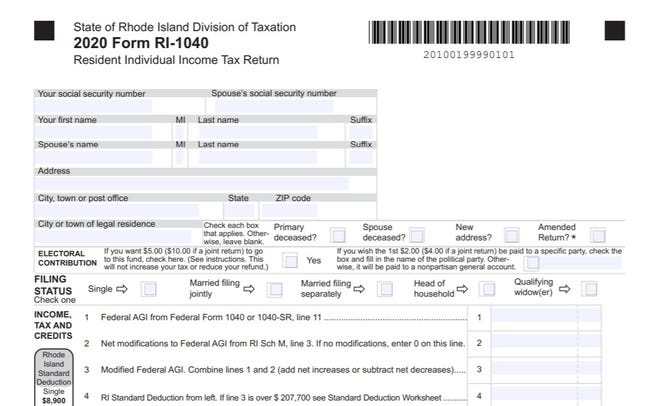

Ri Issues Reminder Taxes Must Be Paid On Unemployment Compensation

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

More Irs Refunds Are On The Way How Unemployment Figures In Wfmynews2 Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

State Income Tax Returns And Unemployment Compensation

Irs Issues More Tax Refunds Relating To Jobless Benefits

Report Unemployment Benefits Income On Your Tax Return

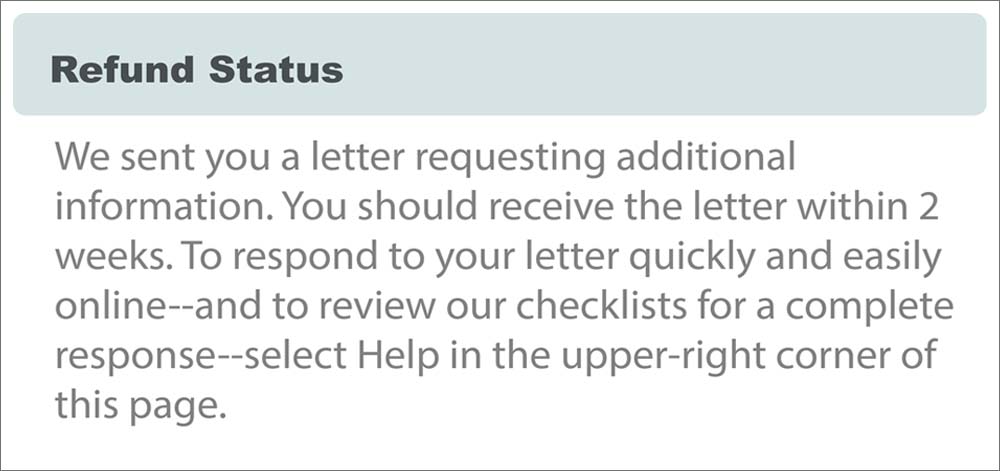

Respond To A Letter Requesting Additional Information

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Irs Tax Refund Tips To Get More Money Back With Write Offs For Unemployment Loans And More Abc7 Chicago

Irs Correcting Tax Returns Issuing Refunds On Unemployment Income Exclusion Njbia